It was revealed yesterday that Lois Lerner’s hard drive was “scratched” (whatever that is supposed to mean) and the data on it was still recoverable. But, that the IRS did not try to recover it, even though that was recommended by in-house IRS IT experts, who felt they should outsource the recovery project.

The IRS instead chose to “shred” (again, what that is supposed to mean), instead, according to a court filing the IRS made to House Ways and Means Committee investigators. They chose this even though they had already been informed that there was an investigation underway into Lerner? Seriously?

Investigators noted that it is unclear whether the scratch was deliberate or accidental.

“It is unbelievable that we cannot get a simple, straight answer from the IRS about this hard drive,” said Ways and Means Committee Chairman Rep. Dave Camp (R-MI). “The Committee was told no data was recoverable and the physical drive was recycled and potentially shredded. To now learn that the hard drive was only scratched, yet the IRS refused to utilize outside experts to recover the data, raises more questions about potential criminal wrong doing at the IRS.”

So first they have the emails, then they don’t have the emails, then they might have the emails… back and forth and back and forth. Just more in a long line of questions about the IRS’ handling of these emails.

Why would they even THINK about destroying the hard drive when they knew Lerner was being looked into unless they (1) had something hide, (2) are completely incompetent as an agency, which is scary considering their role in the implementation of the health care law and their intrusion into our personal financial lives, or (3) both.

Can you even imagine if you went into an IRS audit with record keeping and excuses like this!

]]>

The IRS notified contractors yesterday that it needs help in destroying at least another 3,200 hard drives.

The IRS states in the contract paperwork, “After all media are destroyed, they must not be capable of any reuse or information retrieval.”

The agency is expecting to need to have destroyed at least 65,464 magnetic tapes, 5,856 floppy disks, 708 reels, and 3,225 hard drives. The IRS has amassed half a million pieces of electronic storage media, some with personally identifiable taxpayer information. More than 375,000 pieces have already been destroyed. The rest await destruction.

“Due to system changes, a significant amount of electronic portable media containing [personally identifiable information] and potentially sensitive but unclassified data such as taxpayer return information is being collected at IRS facilities and locked in secure storage areas awaiting destruction,” a statement of work attached to the solicitation said.

What is actually a routine job, meant to protect sensitive taxpayer information, comes off as totally ironic and laughable in light of the IRS hard drive problems surrounding the targeting scandal that is currently under investigation.

In case you are interested, the contract paperwork can be found here.

Given the issues surrounding the missing and destroyed hard drives in this investigation, it makes one wonder why they don’t wait on destroying thousands more…just to be on the safe side, you think?

]]>

In a never ending battle of are there backups of emails or not, House Oversight Committee Chairman Darrel Issa (R-CA) released the transcription of testimony taken last week which shows that the IRS may just be changing it’s story on whether Lois Lerner’s emails are lost or not.

During the transcribed interview, which occurred on Thursday, July 17, with IRS Deputy Associate Chief Counsel Thomas Kane, who supervises the IRS’s targeting scandal document production to Congress, testified that new information now makes him unsure whether email backup tapes containing the Lerner emails in question actually exist or not.

This does not match up with a memo that was sent on June 13, to Senators Ron Wyden (D-OR) and Orrin Hatch (R-UT) by the IRS, which said that the IRS “confirmed that back-up tapes from 2011 no longer exist because they have been recycled.”

According to the release of the testimony by Kane to a Committee investigator:

Investigator: You stated at the time that document was produced to Congress, the document, the white paper in Exhibit 3[the June 13 memo], that it was accurate to the best of your knowledge. Is it still accurate?

Kane: There is an issue as to whether or not there is a – that all of the backup recovery tapes were destroyed on the 6‑month retention schedule.

Investigator: So some of those backup tapes may still exist?

Kane: I don’t know whether they are or they aren’t, but it’s an issue that’s being looked at.

This is the same testimony where we learned that additional IRS employees had also suffered IRS crashes, as we reported yesterday.

Rep. Elijah Cummings (D-MD), the ranking Democrat on the House Oversight and Government Reform Committee, has asked for the committee to end the criticism of Koskinen and ask no further questions. In a letter sent to Issa on Monday from Cummings, he objected to the decision to call IRS Commissioner John Koskinen to testify at a hearing on Wednesday, which would make it the third time Koskinen will have appeared before the committee in the past month.

Cummings has been at odds with the IRS investigation since the start, announcing within 30 days of the start of the investigation that it was all over and nothing more needed to be done, which of course was not true. He, himself, has been implicated in being a apart of the targeting scandal, with some accusing him of trying to shut the investigation down so that his role in the targeting would not come out.

]]>The Daily Caller reported today:

IRS Deputy Associate Chief Counsel Thomas Kane said in transcribed congressional testimony that more IRS officials experienced computer crashes, bringing the total number of crash victims to “less than 20,” and also said that the agency does not know if the lost emails are still backed up somewhere.

This agency has more problems with computers than any company I have ever worked for in my life! Isn’t it crazy that all of these computer crashes are happening to people involved in the IRS targeting investigation? What are the odds?

Let’s see, so far we have computers crashes, with data loss, reported for:

Lois Lerner: The head of the IRS Exempt Organizations division, until she was placed on administrative leave amidst the controversy and is now being held in Contempt of Congress (not that anything will ever be done about that, in my opinion). She, of course, was the one who famously said all of the targeting was done by a few “rogue” employees in a remote field office in Cincinnati. She also plead the Fifth at House Oversight hearings. You know – the Fifth – so she would not incriminate herself in anything criminal. But, she did NOTHING criminal mind you, according to her subsequent statement that no one was allowed to ask her questions on, because she pleaded the Fifth. Say what? How does that work?

Nikole Flax: The former chief of staff to ex-IRS commissioner Steven Miller. You know, the same Steven Miller who visited the White House 118 times in 2010 and 2011. (George W. Bush’s tax chief visited one time in four years. But, I digress.) Ms. Flax visited the White House 31 times herself, between July 12, 2010 and May 8, 2013.

Michelle Eldridge: IRS National Media Relations Chief, who defended the IRS when it came under fire for whistleblower reprisal from its inspector general and Republican Sen. Chuck Grassley (the same Senator we would later find out Lerner tried to target for audit).

Kimberly Kitchens: Agent who donated to Obama’s 2012 campaign and worked in the IRS Exempt Organizations Rulings and Agreements office in Cincinnati in 2012. You know, the same office that Lerner tried to blame back in the beginning for the whole targeting stuff.

Nancy Heagney: Another Cincinatti agent who worked under Lerner.

Julie Chen: An Exempt Organizations agent.

Tyler Chumny: A supervisory agent that served as a Cincinnati-based contact person on at least one tax exempt decision letter signed by Lerner.

So yeah, these were the first seven people who’s computers crashed, that are all tied up in this scandal.

And now we can add the following to the list of computer crashes:

David Fish: Manager of EO Guidance (which develops formal and informal guidance to the public on tax-exempt issues). Also served as Acting Director of Rulings and Agreements in late 2011 and early 2012. Routinely corresponded with Lerner.

Andy Megosh: Group manager in Exempt Organizations guidance. Cited in the Ways and Means Committee’s referral of Lerner to the Justice Department.

Justin Lowe: Lerner’s technical advisor. Prior to that he was a tax-law specialist in EO (Exempt Organizations) Technical and then EO Guidance.

NOT EVEN A SMIDGEN OF CORRUPTION HERE, FOLKS!

Move along. Nothing to see.

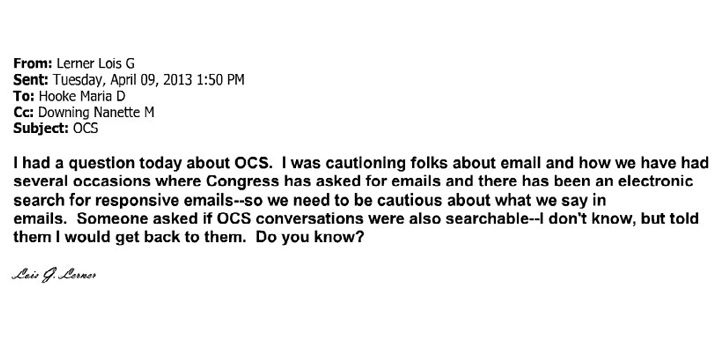

]]>The contents of the emails in question have Lerner asking if conversations that took place within the OCS system were regularly saved and if they could be part of a subpoena for by congressional investigators.

These emails were sent on April 9, 2013, just days after she learned that Congress would be looking into whether the IRS targeted conservative groups for denial of tax exempt status.

In the initial email, sent at 1:50 PM, Lerner asks Maria Hooke, an IRS technology employee, and Nanette Downing, the manager of the unit that evaluated the applications:

I had a question today about OCS. I was cautioning folks about email and how we have had several occasions where Congress has asked for emails and there has been an electronic search for responsive emails – so we need to be cautions about what we say in emails. Someone asked if OCS conversations were also searchable – I don’t know, but told them I would get back to them. Do you know?

A response by Hooke, at 2:45 PM, she states:

OCS messages are not set to automatically save as the standard; however the functionality exists within the software. That being said the parties involved in an OCS conversation can copy and save the contents of the conversation to an email or file.

To date OCS conversation are not specifically identified as part of the Electronic Data Request (EDR) for information, however, if one of the parties saved the conversation as an email or file they would become part of the electronic search.

My general recommendation is to treat the conversations as if it could/is begin saved somewhere, as it is possible for either party of the conversation to retain the information and have it turn up as part of an electronic search.

Make sense?

Lerner’s one word response, sent at 2:51 PM was:

Perfect

The House Oversight Committee has made copies of these emails available to the public.

This is an interesting revelation in the case, given that over two years of Lerner’s actual emails may have gone missing due to a “hard drive crash,” as claimed by IRS Commissioner John Koskinen. Some Republicans have questioned whether the IRS exhausted all efforts to try to recover the emails from the hard drive in 2011.

]]>But, something you won’t hear much about in the news is the lawsuit that was filed by Z-Street, a pro-Isreal organization, who filed for tax exempt status on December 29, 2009, and was told its application for tax exempt status was being delayed because “these cases are being sent to a special unit in the DC office to determine whether the organization’s activities contradict the Administration’s public policies.”

They then filed a lawsuit in August of 2010, alleging unlawful viewpoint discrimination, a First Amendment claim. The IRS tried several arguments to get the claim dismissed, all of which were dismissed by Washington DC federal district court Judge Ketanji Brown Jackson, who was appointed to the bench by President Obama. In her rulings, she noted that Z-Street was not suing to gain tax exempt status, but they were suing over “viewpoint discrimination,” based on what they had been told by IRS agent Diane Gentry about contradicting the Administration’s policies.

Judge Jackson gave the IRS until June 26, 2014 to respond to Z-Street. That deadline has now come and gone, so the case now enters the discovery phase of the process. This means that Z-Street can now subpoena IRS officials, put them under oath and ask them questions, as well as cross examine them closely. They can also subpoena documents and require they be produced.

According the the Jerusalum Post, this may be the case that helps blow the lid on the IRS scandal. The stated, “The Z-Street case may be what forces the IRS to pull aside its carefully contracted curtain and reveal how it made decisions regarding organizations deemed out of step with the current US administration.”

Interestingly enough, the Z-Street case can be very damaging to the IRS, in that its lawsuit was filed in August of 2010, which means the IRS was then under legal obligation to preserve records, which will all now know, from the House hearings, they have not done.

According the the Wall Street Journal’s Review and Outlook column these records must be preserved by law:

Under the Federal Rules of Civil Procedure and legal precedent, once the suit was filed the IRS was required to preserve all evidence relevant to the viewpoint-discrimination charge. That means that no matter what dog ate Lois Lerner’s hard drive or what the IRS habit was of recycling the tapes used to back up its email records of taxpayer information, it had a legal duty not to destroy the evidence in ongoing litigation.

In private white-collar cases, companies facing a lawsuit routinely operate under what is known as a “litigation hold,” instructing employees to affirmatively retain all documents related to the potential litigation. A failure to do that and any resulting document loss amounts to what is called “willful spoliation,” or deliberate destruction of evidence if any of the destroyed documents were potentially relevant to the litigation.

At the IRS, that requirement applied to all correspondence regarding Z Street, as well as to information related to the vetting of conservative groups whose applications for tax-exempt status were delayed during an election season. Instead, and incredibly, the IRS cancelled its contract with email-archiving firm Sonasoft shortly after Ms. Lerner’s computer “crash” in June 2011.

In the federal District of Columbia circuit where Z Street’s case is now pending, the operating legal obligation is that “negligent or reckless spoliation of evidence is an independent and actionable tort.” In a 2011 case a D.C. district court also noted that “Once a party reasonably anticipates litigation, it must suspend its routine document retention/destruction policy and put in place a ‘litigation hold’ to ensure the preservation of relevant documents.”

The government’s duty is equally pressing. “When the United States comes into court as a party in a civil suit, it is subject to the Federal Rules of Civil Procedure as any other litigant,” the Court of Federal Claims ruled in 2007. The responsibility to preserve evidence should have been a topic of conversation between the IRS chief counsel’s office and the Justice Department lawyers assigned to handle the Z Street case.

Because we now know that evidence was not persevered, due to the failure to properly recover emails from a computer crash, even when they could have done so from backup tapes, at the time, this could become a separate tort case, and opens up the door for judicial inquiry into the IRS destruction of evidence.

Of course, not surprisingly, this whole lawsuit has gotten very little media coverage, despite the potential major implications of it for the IRS.

]]>